Pennyflo

About Pennyflo

Pennyflo transforms cash flow management for businesses by automating and simplifying financial tasks. Targeting finance teams, it offers real-time cash flow visibility and dynamic forecasting capabilities. Its innovative AI co-pilot enhances decision-making, saving time and reducing cash shortages, ensuring a sustainable, profitable business.

Pennyflo offers various subscription plans, catering to businesses of all sizes. Each tier provides access to AI-driven cash flow tools and unique features tailored to finance teams' needs. Upgrading enhances reporting capabilities and integrates seamlessly with existing tools, delivering comprehensive financial insights and efficiency.

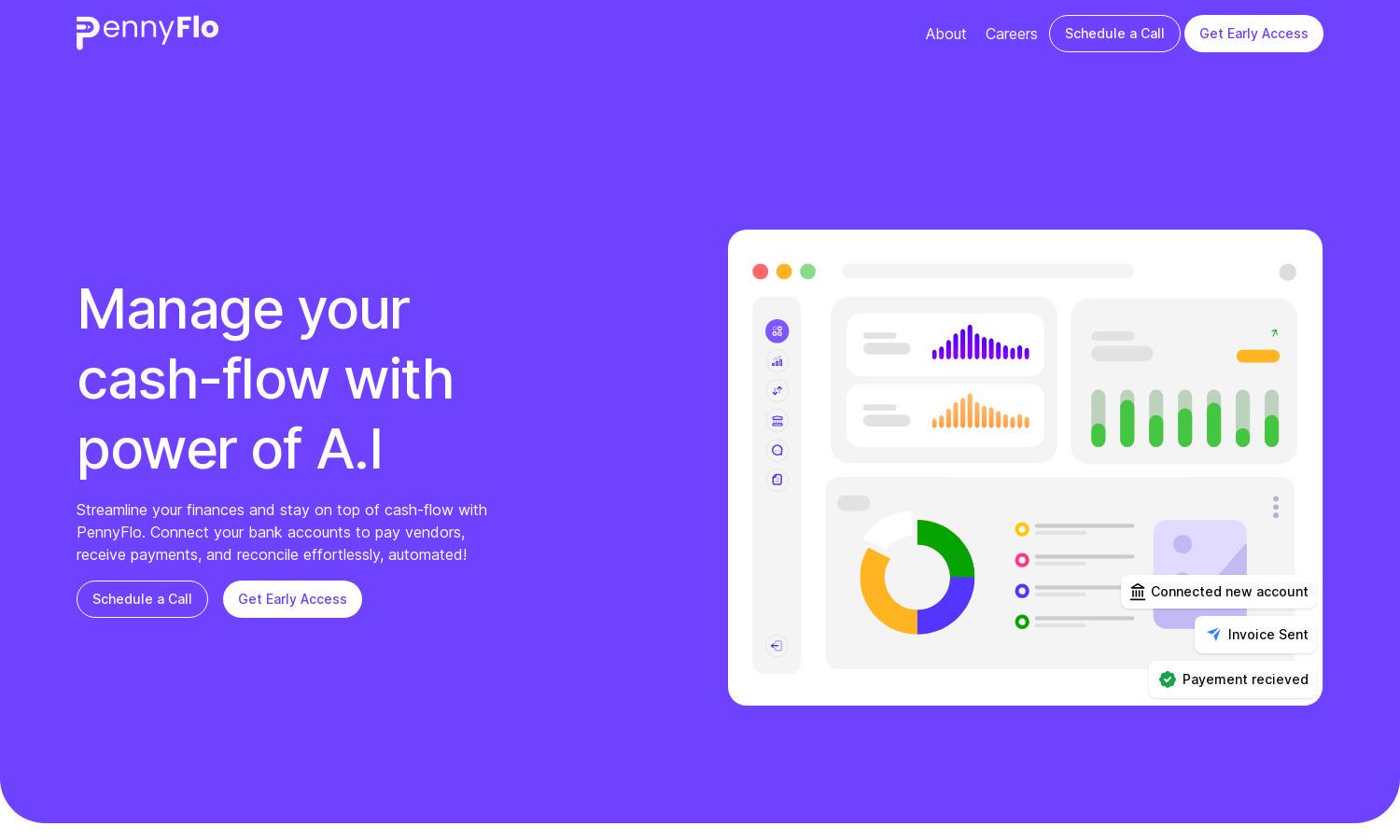

Pennyflo's user interface is sleek and intuitive, designed for seamless navigation and usability. Users can quickly access key features and generate insightful reports through a streamlined layout. This thoughtful design enhances the overall experience, making it easier for teams to work efficiently with Pennyflo.

How Pennyflo works

Users begin with a simple onboarding process on Pennyflo, entering their financial data for analysis. The platform then offers a unified view of cash flow, with built-in automation for banking and reconciliations. Users navigate effortlessly, leveraging dynamic forecasts and reporting features, enhancing decision-making and collaboration.

Key Features for Pennyflo

AI-Powered Cash Management

The AI-powered cash management feature of Pennyflo revolutionizes finance teams' workflow. By automating repetitive tasks and providing real-time insights, this unique aspect allows users to focus on strategic decision-making, ultimately improving cash management efficiency and reducing the risk of cash shortages.

Dynamic Forecasting

Pennyflo's dynamic forecasting feature utilizes real-time data to help businesses plan for future scenarios. By analyzing past patterns and current cash flow, this innovative tool provides actionable insights, allowing finance teams to navigate uncertainties and make informed financial decisions confidently.

Automated Banking & Reconciliations

Automated banking and reconciliation in Pennyflo streamlines financial operations by reducing manual input errors. This feature automatically reconciles transactions, offering a comprehensive view of cash flow and saving time for finance teams while enhancing accuracy and efficiency in cash management processes.